Table of Contents

DigitalOcean Holdings (DOCN) has taken an advance in the AI area by introducing an increased partnership with fal to make advanced image and voice generation designs offered through its Gradient AI Platform. This action opens brand-new opportunities for startups and enterprises making use of DigitalOcean’s cloud services.

See our most recent evaluation for DigitalOcean Holdings.

DigitalOcean’s growing concentrate on AI has actually dovetailed with remarkable energy in its share price. After surging over 50 % in the last quarter, the 1 -year overall shareholder return is now virtually flat at -0. 4 %. While the lasting picture stays positive with a three-year total return of 33 2 %, current gains suggest renewed positive outlook around the business’s growth trajectory and expanding ecological community.

If the current AI partnership has you interested about what else is gaining vapor, now’s an excellent moment to expand your point of view and find See the full listing free of charge.

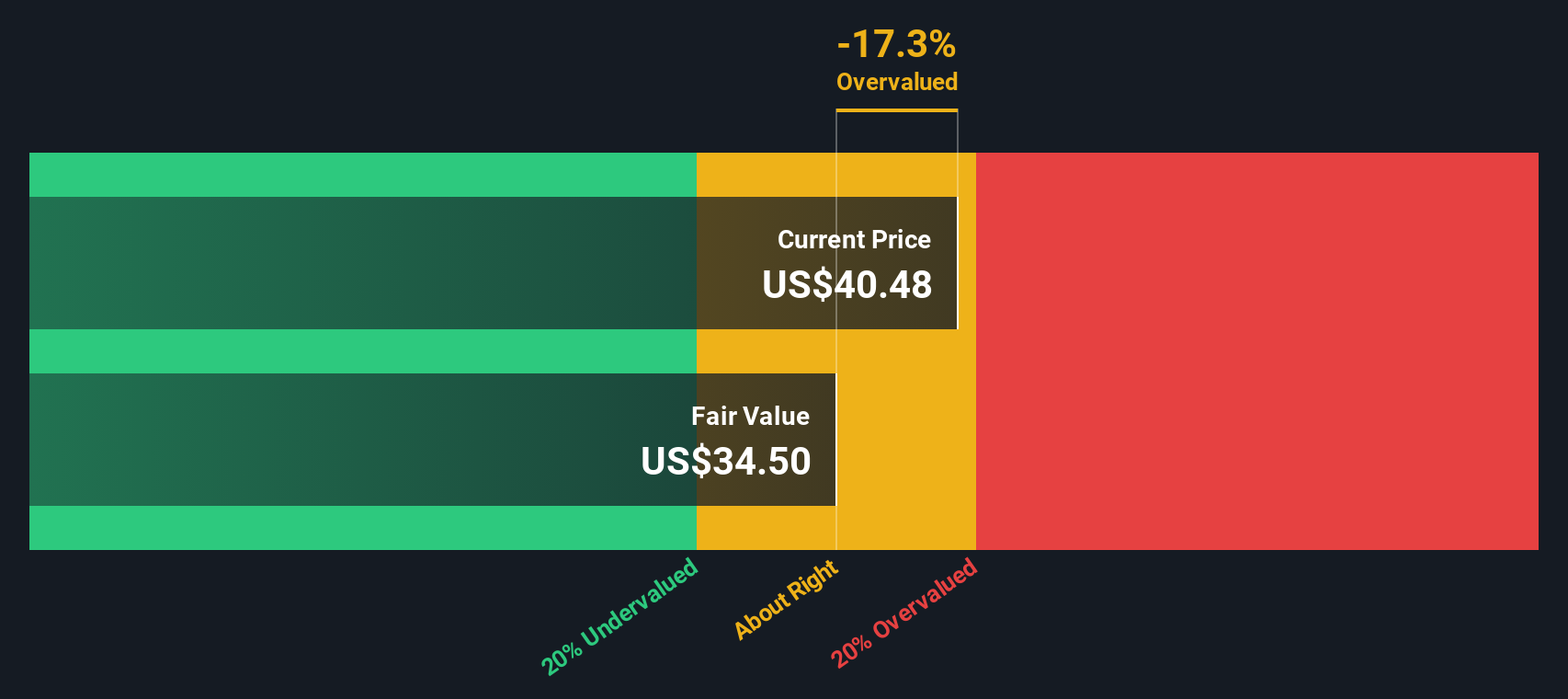

Yet with shares rebounding in recent months, capitalists might question if DigitalOcean’s next chapter of AI development is still undervalued or if the market is already pricing in much of its future potential growth.

Most Popular Story: 2 % Undervalued

The story’s reasonable worth of $ 41 60 sits just over DigitalOcean’s last close at $ 40 66, setting up a close argument on prices and future prospects. A stimulant for optimism emerges from how the company is expanding its reach and reinforcing its financials.

Material development utilizing direct sales, improved product-led development movements, and critical collaborations to both win multiyear, dedicated contracts and help with work movements from rivals supplies higher visibility right into future capital. This sustains stronger future revenues predictability and boosted cost-free cash flow margins.

Read the full narrative.

Want to know what’s sustaining this appraisal? One of the most popular narrative depend upon strong development assumptions. Experts bet on a leap in revenues, reducing margins, and an earnings surge by 2028 All set to unbox what’s driving this rate target and what it means for DigitalOcean’s following phase?

Outcome: Fair Worth of $ 41 60 (UNDERESTIMATED)

Have a read of the narrative in full and understand what’s behind the projections.

However, expanding competitors from hyperscaler clouds and unforeseeable changes in AI demand could challenge DigitalOcean’s capacity to preserve its present growth momentum.

Discover the crucial dangers to this DigitalOcean Holdings narrative.

One more Sight: What Regarding Our DCF Version?

While the preferred analyst story sees DigitalOcean as undervalued, our SWS DCF model gives a various angle. Based on forecasted future capital, it suggests shares may be trading above the estimate of reasonable worth right now. Could this imply the optimism is a step ahead of principles, or is the market just pricing in future potential?

Look into exactly how the SWS DCF version reaches its reasonable worth.

Simply Wall St does a discounted capital (DCF) on every stock on the planet everyday (check out DigitalOcean Holdings for instance). We reveal the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this adjustments, or use our stock screener to find 840 underestimated supplies based on their cash flows. If you save a screener we also signal you when new companies match – so you never miss a prospective possibility.

Construct Your Own DigitalOcean Holdings Story

If this sight isn’t rather your own or you ‘d rather study the data firsthand, you can assemble your very own take on DigitalOcean’s tale in just a few mins, and Do it your way.

A terrific base for your DigitalOcean Holdings research study is our analysis highlighting 4 crucial incentives and 3 essential indication that can influence your financial investment decision.

Looking for More Investment Ideas?

Smart capitalists constantly check for tomorrow’s winners. Do not miss your possibility to identify effective patterns early. There are impressive chances that few are taking note of now.

This short article by Merely Wall surface St is basic in nature. We give discourse based on historic information

and expert forecasts just utilizing an honest approach and our posts are not meant to be economic recommendations. It does not make up a suggestion to buy or offer any type of stock, and does not gauge your objectives, or your

monetary circumstance. We intend to bring you lasting concentrated evaluation driven by essential data.

Keep in mind that our evaluation might not factor in the current price-sensitive company news or qualitative product.

Merely Wall Surface St has no placement in any type of stocks stated.

New: Take care of All Your Stock Portfolios in One Place

We have actually created the utmost portfolio buddy for stock investors, and it’s complimentary.

• Connect an unlimited number of Portfolios and see your total amount in one currency

• Be alerted to brand-new Warning Signs or Risks through e-mail or mobile

• Track the Fair Worth of your supplies

Attempt a Trial Profile totally free

Have feedback on this short article? Concerned concerning the web content? Get in touch with us straight. Alternatively, e-mail editorial-team@simplywallst.com