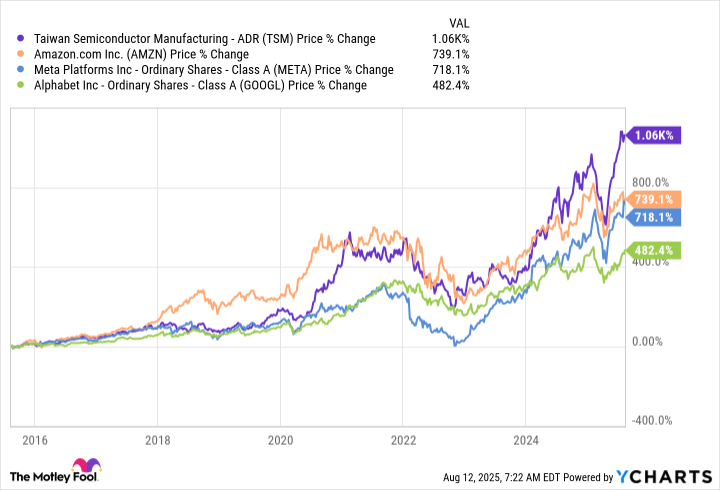

Among the top performers over the previous decade have actually been Nvidia (NVDA -0. 86% , Taiwan Semiconductor Manufacturing (TSM -0. 85 % , Amazon (AMZN -0. 00 % , Meta Systems (META 0. 38 % , and Alphabet (GOOG 0. [

***********************************************************]% (GOOGL 0. 46 % I removed Nvidia from the chart below due to the fact that it’s up over 30, 000%in the past years, which skews the graph, yet the other 4 have actually likewise done phenomenally well.

< p data-pm-slice =" 1 1 [] data-prosemirror-content-type="node" data-prosemirror-node-block="true" data-prosemirror-node-name="paragraph" >

The “worst” entertainer of the continuing to be four has actually been Alphabet, with its stock rising nearly 5 times in value.

These 5 stocks have had a solid run over the previous years, yet I still think they are exceptional picks for the following decade

, mainly due to the proliferation of artificial intelligence(AI ). They are at the top of my listing today, and I think acquiring shares with the frame of mind of holding for the following years is a wise investment approach.

Image source: Getty Images.

Nvidia and Taiwan Semiconductor are supplying AI calculating power [*******************************

]

All 5 of these stocks are profiting in various ways from the

Nvidia makes graphics processing devices( GPUs ), which are presently the most preferred computer equipment for running and training

There’s still a significant

Taiwan Semiconductor (TSMC for brief)is a producer that

produces chips for a number of the major gamers in

Nvidia and Taiwan Semiconductor are seeing big development now due to the fact that they’re offering the computing power required for

A lot more AI applications will certainly increase over the following couple of years

In the beginning glimpse, Amazon does not look like much of an

It’s seeing strong need for increased computer capacity for

Meta Platforms is developing its very own internal generative

Meta has 2 of the most significant social media systems, Facebook and Instagram, which produce a lot of their cash with advertisement profits. The business has actually integrated

Finally is Alphabet. Several think Alphabet will certainly be displaced by

Part of its success can be credited to the rise of its Look Summaries, which are a crossbreed between a typical online search engine and generative

Keithen Drury has positions in Alphabet, Amazon, Meta Operatings Systems, Nvidia, and Taiwan Semiconductor Production. The has placements in and advises Alphabet, Amazon, Meta Operatings Systems, Nvidia, and Taiwan Semiconductor Manufacturing. The has a disclosure plan.